The NCTAP program is available to any student who is an eligible member of the North Carolina National Guard and pays tuition/fees. Students who wish to use TAP must apply for NCTAP online by clicking on the link below

Financial Aid

<<<NEW – Direct Deposit for Student Financial Aid Refunds>>>

WELCOME TO THE FINANCIAL AID OFFICE

Your education at Robeson Community College is one of the most valuable investments you will make in your life. The financial aid office is committed to helping you find ways to finance your education because we believe attending college should not be limited by your family’s financial resources. We have designed this website to help guide you through the financial aid process. We urge you to stay informed and in control of your education by browsing through our website, checking your RCC student email, and checking your Self-Service student portal.

To get STARTED, click on the buttons below.

|

|

CHECK YOUR STATUS |

SUBMIT DOCUMENTS |

ACCESS YOUR EMAIL |

- Apply Now

- Types of Aid

- SCHOLARSHIPS

- COST OF ATTENDANCE

- VETERANS

- EMPLOYMENT

- POLICIES

- FAQ

- Important Dates

- CONTACT US

- HABLAMOS ESPANOL

steps to apply for or renew your financial aid

|

CREATE A FSA ID USERNAME & PASSWORD: An FSA ID is a username and password that gives you access to Federal Student Aid’s online systems and can serve as your legal signature. For Dependent students, your parent must create their own FSA ID. Click on the link above to get started. |

|

COMPLETE THE FREE APPLICATION FOR FEDERAL STUDENT AID (FAFSA) EVERY YEAR: On October 1st of every year, the FAFSA is available for the new school year. Add RCC’s federal school code of 008612. Don’t forget to hit the submit button once completed. Allow 3-5 business days for your FAFSA to be processed and sent to RCC. To get started, click on the FAFSA link!

|

|

SUBMIT ALL REQUESTED DOCUMENTS ASAP: Once RCC’s Financial Aid Office receives your completed FAFSA, we will notify you via your RCC Student Email if further documents are needed to complete processing. Allow 1-2 weeks for processing. CHECK YOUR STATUS by logging into your student Self-Service portal to view a list of documents requested and/or your financial aid offer. |

- Eligibility Requirements

-

To be eligible to receive federal and/or state student aid, you must:

- Be a citizen or eligible non-citizen of the United States.

- Have a valid Social Security Number. (Students from the Republic of the Marshall Islands, Federated States of Micronesia, and the Republic of Palau are exempt from this requirement.)

- Have a high school diploma or a General Education Development (GED) certificate or have completed homeschooling.

- Be enrolled in an eligible program as a regular student seeking a degree or certificate.

- Maintain satisfactory academic progress.

- Not owe a refund on a federal student grant or be in default on a federal student loan.

- Register (or already be registered) with the Selective Service System, if you are a male and not currently on active duty in the U.S. Armed Forces. (Students from the Federated States of Micronesia, the Republic of the Marshall Islands and the Republic of Palau are exempt from registering; see www.sss.gov for more information.)

- Not have a conviction for the possession or sale of illegal drugs for an offense that occurred while you were receiving federal student aid (such as grants, work-study, or loans). If you have such a conviction, you must complete the Student Aid Eligibility Worksheet to determine if you are eligible for aid or partially eligible for aid.

Many types of student aid also require you to have financial need. Additionally, once you have a bachelor’s degree or a first professional degree, you are generally not eligible for certain types of aid.

- FEDERAL PELL GRANT

-

Federal Pell Grants usually are awarded only to undergraduate students who display exceptional financial need and have not earned a bachelor’s, graduate, or professional degree. (In some cases, however, a student enrolled in a postbaccalaureate teacher certification program might receive a Federal Pell Grant.) A Federal Pell Grant, unlike a loan, does not have to be repaid, except under certain circumstances. To apply for a federal Pell grant, students should start by submitting a Free Application for Federal Student Aid (FAFSA®) form. Schools use the information on the FAFSA® form to determine your eligibility for a Pell Grant, and if so, how much you’re eligible to receive. You will have to fill out the FAFSA form every year you’re in school to stay eligible for federal student aid, including Pell Grant awards.

Award Amounts:

2023–24 Award Year

The maximum Federal Pell Grant award is $7,395 for the 2023–24 award year (July 1, 2023, to June 30, 2024).2024–25 Award Year

The maximum Federal Pell Grant award is $7,395 for the 2024–25 award year (July 1, 2024, to June 30, 2025).The amount you get, though, will depend on

-

your Expected Family Contribution (2023-24 FAFSA form) or your Student Aid Index (2024-25 FAFSA form),

-

the cost of attendance (determined by your school for your specific program),

-

your status as a full-time (12 credits or more) or part-time student (less than 12 credit hours), and

-

your plans to attend school for a full academic year or less.

Please note that you can receive the Federal Pell Grant for no more than 12 terms full-time terms or the equivalent (roughly six years). You’ll receive a notice if you’re getting close to your limit. If you have any questions, contact your financial aid office.

-

- FEDERAL SUPPLEMENTAL EDUCATIONAL OPPORTUNITY GRANT (FSEOG):

-

A Federal Supplemental Educational Opportunity Grant (FSEOG) is a grant for undergraduate students with exceptional financial need. To get an FSEOG, you must fill out the Free Application for Federal Student Aid (FAFSA®) form so your college can determine how much financial need you have. The financial aid office will award FSEOGs to students that have the most financial need. The FSEOG does not need to be repaid, except under certain circumstances. FSEOG gives priority to students with the lowest Student Aid Index (SAI) and who apply the earliest in the year. Students with bachelor’s degrees are not eligible.

Award Amounts: $400 per year (Fall and Spring). May qualify for a summer award.

- FEDERAL WORK-STUDY

-

The Federal Work-Study program provides part-time jobs for undergraduate and graduate students with financial need, allowing them to earn money to help pay education expenses. The program encourages community service work and work related to the student’s course of study. Students with bachelor’s degrees are eligible.

Eligibility:

- Must complete a FAFSA

- Must be enrolled in at least 6 credit hours

- Must maintain satisfactory academic progress

- Must have financial need

- May work an average of 15 – 20 hours per week.

To apply for an available position, please complete the Federal Work-Study Application Form and submit to the Financial Aid Office.

Award Amounts: FWS funds are limited to availability of positions, funds, and completion of the interview process. Students are paid on the last working day of each month, and the amount paid is according to the position and the number of hours worked. Hourly pay rate is $12.00 for on-campus jobs and $12.50 for off-campus jobs.

Contact: (910) 272-3352, or email at finaid@robeson.edu

- VETERANS BENEFITS

-

Robeson Community College is approved by the Veterans Administration as a training facility for veterans. The Office of Veterans Services, located in the Financial Aid Office in Building 13, coordinates services to over 100 veterans, dependents, guardsmen, and reservists attending classes and receiving veterans’ benefits.

Click here to learn more about Veterans at RCC

Award Amount: Varies

- NC NEXT SCHOLARSHIP

-

The North Carolina Scholarship

Description

The Next NC Scholarship, beginning in the 2024-2025 academic year, combines the federal Pell Grant with the state-funded financial aid program to form a simplified and predictable scholarship award that’s easier to understand and makes education more affordable for most North Carolinians.

Students enrolling at a North Carolina Community College with an Adjusted Gross Income (AGI) of $80,000 or less and a Student Aid Index (SAI) of 7,500 or less, as reported on the FAFSA, are guaranteed at least $3,000 from combined federal and state aid.

Eligibility- Be a North Carolina resident as defined by the North Carolina Residency Manual

- Enroll for at least 6 credit hours

- Be admitted, enrolled, and classified as an undergraduate student in matriculated status in a degree, certificate, or diploma program at one of the 16 institutions of The University of North Carolina or at a North Carolina Community College

Application RequirementsApplicants must complete the Free Application for Federal Student Aid (FAFSA) listing a UNC institution or North Carolina Community College. The FAFSA opens on October 1.Other InformationConsideration for funding is automatic once the FAFSA is filed. The FAFSA filing priority date* for the Next NC Scholarship is August 15 for UNC Institutions (applies to 2024-2025 Academic Year only) and August 15 for North Carolina Community Colleges. Applicants completing the FAFSA after these dates may be denied if insufficient funds are available.

*Colleges may set different priority dates to assist in awarding of financial aid other than the Next NC Scholarship. Check the priority date for your college to ensure timely FAFSA filing and access to other types of financial aid but file your FAFSA even if the priority date for your college and/or the Next NC Scholarship priority date has passed as some funding, including Federal grants and loans, will still be available.

- LONGLEAF COMMITMENT GRANT

-

NORTH CAROLINA LONGLEAF COMMITMENT GRANT

Description:

The Longleaf Commitment Grant (LCG) was established as part of the Governor’s Emergency Education Relief Fund (GEER) for 2022 and 2023. NC high school graduates with EFCs between 0 and 15,000 attending an NC community college during the 2022-2023 academic years (2022 HS graduates) and 2023-2024 academic years (2023 HS graduates).

Eligibility Requirements for 2021 & 2022 Graduates.

- Be a 2022-2023 NC high school graduate.**

- Be a North Carolina resident according to the NC Residency Determination Service.**

- Be a first-time college student (Career & College Promise (CCP) and Early/Middle College High School students are eligible.

- Enroll in a curriculum program during the Fall 2022 semester.

- Enroll in at least 6 credit hours per semester.

- Complete the Free Application for Federal Student Aid (FAFSA) for 2022-23 and subsequent years.

- Have an Expected Family Contribution (EFC) from $0 – $15,000. (“EFC” is based upon student’s FAFSA determination)

- Renew FAFSA for the 2023-24 academic year and meet the Satisfactory Academic Progress requirements of the college

**Some North Carolina residents who graduated from a non-North Carolina high school may be eligible.

Award Amount: Full-time eligible students are guaranteed to receive $700 to $2,800 per year, for a total of two years. Less than full-time students may receive a partial award. The Longleaf Commitment Grant Program ends at the conclusion of the 2024 spring semester.

- OTHER STATE AID

-

Forgivable Education Loans for Service (FELS):

Description Established by the North Carolina General Assembly in 2011, the Forgivable Education Loans for Service provides financial assistance to qualified students enrolled in an approved education program and committed to working in critical employment shortage professions in North Carolina. For the 2020-2021 academic year eligible degree programs may be found by clicking the link below. The North Carolina State Education Assistance Authority provides administration for the program. Eligibility A recipient must meet the following eligibility criteria to be considered for FELS: - Be a legal North Carolina resident and NC resident for tuition purposes

- At the time of application, present a cumulative minimum grade point average (GPA) of:

- 3.00 for graduating high school students (weighted GPA)

- 2.80 for undergraduate students pursuing an associate or bachelor’s degree

- 3.20 for students pursuing a graduate or professional degree

- Register with the Selective Service System, if required;

- Recipients must not be in default, or does not owe a refund, under any federal or State loan or grant program

- Maintain Satisfactory Academic Progress according to the enrolling policy of the institution.

- Be willing to work in NC in a designated critical employment shortage profession (careers corresponding with a FELS Approved Program); and

- Must plan to enroll in at least six credit hours in an Approved Program at an Eligible Institution.

Note: You do not have to be admitted to the program when you apply, but you must be admitted prior to receiving funding, if selected.

Application Procedure: The application is available the first Monday in December. The deadline for applying is March 1st. Applications will be entered into a lottery for award consideration.

APPLY FOR FELS

NC REACH:

NC Reach is a state-funded scholarship offered to qualified applicants for up to 4 years of undergraduate study at NC public universities and community colleges. Available funding is awarded to students, after all other financial aid, public funds and scholarships have been processed and applied to their account. NC Reach provides comprehensive student support to help all students be able to navigate their post-secondary education.

Eligibility Guidelines

-

- Eligible students are those who are legal residents of North Carolina eligible for in-state tuition rates. Click HERE for a full explanation of NC residency requirements.

- Those who have aged out of North Carolina foster care at age 18; or…

- Those who have been adopted from North Carolina foster care on or after their 12th birthday.

- Exited from foster care to a permanent home through guardianship with the support of the Kinship Guardianship Assistance Program (KinGAP)

- Students may qualify through age 25.

APPLY FOR NC REACH

NC National Guard Tuition Assistance Program (NCTAP):

APPLY FOR NCTAP

- LRDA (WIOA)

-

LRDA Workforce Innovation & Opportunity Act

The Workforce Investment Act program (WIOA) has served as a leader in providing employment and training opportunities for over 25 years. WIOA is funded by the Department of Labor. The purpose of Subtitle D, Section 166 (Indian and Native American Programs) is to support the employment and training activities for Indian, Alaska Native and Hawaiian individuals. Eligible veterans and their spouses will receive priority service. Components include Work Experience, Educational Training, Job Skill Training, Job Search, Job Readiness, Job Development, Job Placement and Career Planning.

Eligibility Requirements:

Applicants must be:

- American Indian, Alaska Native or Native Hawaiian

- Unemployed, underemployed, or low-income

- Reside in Robeson, Bladen, Hoke, or Scotland County

To apply for the WIOA Program please visit the LRDA office and complete an application. For further information please contact the WIOA office at one of the addresses:

Click the link for a WIOA Career Pathway Interest Form

Robeson Robeson County

LRDA WIOA

636 Prospect Road

Pembroke, NC 28372

(910) 521-9761 or Fax: (910) 668-1259

Monday – Friday

8:00am – 5:00pmHoke County

LRDA WIOA

22 West Elwood Ave.– P.O. Box 485

Raeford, NC 28376(910) 875-5742 or Fax: (910) 875-6897

Monday – Friday

8:00am – 5:00pm - NC WORKS (WIOA)

-

WIOA Youth Services

The WIOA program is designed to assist eligible participants in gaining skills, education, and work experience to achieve successful employment outcomes. To participate in the program, applicants must meet specific eligibility criteria and may benefit from various supportive services, training, and employment opportunities.

Eligibility Requirements

To qualify for the WIOA program, applicants must meet the following criteria:

- Work Authorization:

- Be a U.S. citizen or a noncitizen authorized to work in the United States

- Selective Service Registration:

- Males aged 18-24 must meet military Selective Service registration requirements

- Age Requirements:

- In-School Youth: Must be between 14 and 21 years old

- Out-of-School Youth: Must be between 16 and 24 years old

May assist with the following:

- Tuition & Fees

- Books, Uniforms, & Background Checks

- Test Fees

- Travel Reimbursement

- Other resources necessary for success in training or employment

Contact: Casandra Gales at 910-827-2086

_________________________________________________________________________________________________________

WIOA Adult Services

- Work Authorization:

- Finish Line Grant

-

The Finish Line Grant are grants of up to $1,000 awarded to community college students who are on the cusp of completing their education or training and are faced with an unforeseen financial hardship that may prevent them from doing so.

Guidelines

- Must be an unforeseen financial hardship (must provide documentation of unforeseen financial hardship)

- Up to $1,000, per student per semester (awards are evaluated on a case-by-case basis)

- Be enrolled at RCC in a curriculum program or eligible workforce continuing education course leading to an industry-recognized credential.

- Must be in good academic standing as outlined by RCC policies (minimum of 2.0 GPA)

- Must be a current student who has completed (or be enrolled in the courses that will constitute 25% completion) at least 25% of their primary course of study

Examples of Qualifying Expenses:

(The Finish Grant can only be used for current bills. No past due bills will be accepted.)

- Rent assistance

- Unexpected car repairs (must be enrolled for in-person classes)

- Books & other course materials (exam fees, etc.)

- Utility bill (water, gas, and electric)

- Childcare assistance

- Bus passes (S.E.A.T.S)

- Medical expenses

- Internet services (internet bill statement only)

To apply, complete the Finish Line Grant Application1 as well as submit documentation of unforeseen financial hardship and current qualifying expense(s). Submission of an application does not guarantee automatic approval. Awards are evaluated on a case-by-case basis and will include factors such as, but not limited to the following: financial hardship, previous requests, eligibility for additional types of aid, etc.

For more information, please contact a financial aid representative via phone at (910) 272-3352 or email finaid@robeson.edu.

- Private Loans

-

A private education loan is a non-federal loan that is made by a lender such as a bank, credit union, state agency, or a school to a borrower expressly for postsecondary educational expenses.

RCC does not have a preferred lender list for private loans. Students have the right and ability to select the education loan provider of their choice. To find private student loan lenders, you should explore all available options.

Please review the federal aid section on the U.S. Department of Education website for an explanation between Federal and Private Loans.

Note: RCC does not participate in the federal student loan program.

Helpful Hints

Borrow only what is needed to cover your educational expenses. These funds must be repaid.

Most private lenders require a good credit rating and may also require a co-signer. Be informed and explore your options.

How to Apply

If you are interested in a private education loan to attend Robeson Community College, review the following steps:

- Apply for a private education loan with the lender of your choice

- Have a valid FAFSA on file with RCC’s school code: 008612

- Submit all documents required to complete financial aid processing

- Be enrolled for at least 6 credit hours

Certification

The Financial Aid Office will certify the loan once we receive a certification request from your lender of choice. Private loan limits cannot exceed your cost of attendance minus any financial aid received.

In accordance with Section 155 of the Higher Education Act of 1965 (HEA), as amended, and to satisfy the requirement of Section 128(e)(3) of the Truth in Lending Act, a lender must obtain a self-certification form signed by the applicant before disbursing a private education loan. The school is required on request to provide this form or the required information only for students admitted or enrolled at the school. Throughout this Applicant Self-Certification, “you” and “your” refer to the applicant who is applying for the loan. The applicant and the student may be the same person.

Access the Private Education Loan Applicant Self-Certification

Disbursement of Funds

Private loans are disbursed according to RCC’s standard disbursement schedule (see Important Dates tab). RCC is not responsible for the timeliness of private loan funds. All customer service inquiries should be addressed to the chosen lender. Depending on the timeline of the private loan process (which can vary with each lender), RCC cannot guarantee that private loan funds will be certified and applied to your student account before payment deadlines. You are expected to make the necessary arrangements for payment of tuition, fees, and other charges.

SCHOLARSHIPS

There is an abundance of scholarships provided by internal & external agencies such as schools, clubs, churches, organizations, employers, etc. that are available to help you pay for your college expenses. RCC’s Financial Aid Office urges you to take advantage of all the scholarship opportunities available to you. Check out the list of scholarship tools below, search available scholarships, and APPLY, APPLY, APPLY!

| RCC Foundation Scholarship | |

| Wells Fargo Technical Scholarship | Golden LEAF Scholarship |

|

State Employees Credit Union “People Helping People” Scholarship |

Targeted Assistance High Demand/Low Enrollment Program

|

|

Click on link and then click on “VA Educational Benefits tab”. |

|

| North Carolina Community Colleges Foundation Scholarship for Health Careers | North Carolina Community Colleges Foundation Endowment for Teacher Preparation |

| Scholarships.com | |

For more information on scholarships, please contact Mrs. Brittany Moore, Scholarship Coordinator, at 910-272-3352 or email finaid@robeson.edu

The Financial Aid Cost of Attendance is the estimated cost of completing a year (two semesters) of full-time attendance at college. This generally includes tuition and fees, housing, food, books and supplies, personal and miscellaneous expenses. The Financial Aid Office uses these costs to develop standard student budgets for awarding financial aid funds. Estimated student budgets reflect typical “modest but adequate” expense patterns of Robeson Community College students based on research conducted by the Financial Aid Office. Enrollment level, number of completed credits, major field of study, and room and board (dependent/independent) options all contribute to the determination of the costs. While actual expenses will depend on your lifestyle and level of enrollment, the estimated costs listed on this page should assist you in planning your own budget. You can find more information abouts costs and fees on the Business Office’s website.

2025-2026 Cost of Attendance

|

||||

|

Nine-Month Budget |

IN-STATE RESIDENT |

OUT-OF-STATE RESIDENT |

||

|

Off-Campus Full-Time |

W/ Parent Full-Time |

Off-Campus Full-Time |

W/ Parent Full-Time |

|

|

Tuition and Fees |

$2,581 |

$2,581 |

$8,725 |

$8,725 |

|

Books and Supplies |

$1,400 |

$1,400 |

$1,400 |

$1,400 |

|

Living Expenses (Food & Housing) |

$9,817 |

$1,472 |

$9,817 |

$1,472 |

|

Transportation |

$2,000 |

$2,000 |

$2,000 |

$2,000 |

|

Miscellaneous & Personal Expenses |

$6,363 |

$6,363 |

$6,363 |

$6,363 |

|

TOTAL |

$21,661 |

$13,816 |

$28,305 |

$19,960 |

BUDGETING:

Taking time to make a budget can help you make smart financial decisions today and reach your goals in the future. Setting up your budget is simple. You just need to take the time to get started. To learn more about personal budgeting, visit http://StudentAid.gov/Budget.

Welcome service members, veterans, and families!

Robeson Community College is proud to serve our military veterans and their families. The Office of Veterans Services, located in the Financial Aid Office in Building 13, coordinates services to over 100 veterans, dependents, guardsmen, and reservists attending classes and receiving veterans’ educational benefits.

Click here to learn more about Veterans at RCC

EARN MONEY, GAIN EXPERIENCE, NETWORK!!!

The Federal Work-Study program provides part-time jobs for undergraduate and graduate students with financial needs, allowing them to earn money to help pay education expenses. The program encourages community service work and work related to the student’s course of study. The hourly rate is $12.00 per hour for on-campus positions.

To apply for an available position, please complete the Federal Work-Study Application Form and submit it to the Financial Aid Office.

ALL POSITIONS HAVE BEEN FILLED AT THIS TIME – PLEASE CHECK BACK AND MONITOR YOUR EMAIL FOR ANY NEW JOB ANNOUCEMENTS.

- SATISFACTORY ACADEMIC PROGRESS (SAP)

-

Satisfactory Academic Progress (SAP) Policy

In accordance with federal and state regulations, Robeson Community College’s Financial Aid Office is required to evaluate a student’s satisfactory academic progress at the end of each term (fall, spring, summer), to determine financial aid eligibility for the following term.

RCC does not use different student categories for SAP purposes. All categories of students (full-time, half-time, etc.) are treated equally under the SAP Policy. A newly admitted student that files a Free Application for Federal Student Aid (FAFSA) and for which there is no SAP status on the student record will have an SAP evaluation performed based on the student’s prior RCC enrollment record and/or any transfer credits, as applicable. A first-time student with no prior college enrollment will always be assigned a “Satisfactory” status and is aid eligible.

Satisfactory academic progress evaluations will include all periods of enrollment whether students received or did not receive financial aid for periods of enrollment and include credit hours earned at other institutions and transferred into the student’s program of study at RCC.

To maintain eligibility for financial aid, students MUST meet the following requirements:

Qualitative Standard

- Minimum (GPA): Maintain a cumulative 2.0 GPA.

Quantitative Standard

- Completion Rate (PACE): Complete 67% percent of the total cumulative credit hours attempted. For example, if a student has attempted 12 credits, the student must complete 9 credits to meet the completion rate requirement.

- Maximum Timeframe: Complete the requirements for an eligible program of study within a timeframe not to exceed 150% of the published program length. For example, if an academic program length is 60 credit hours, the maximum credit hours that are eligible for financial aid is 90 (60 * 150% = 90). Students may only receive financial aid for no more than two associate degree programs at RCC

Note: Remedial coursework will be included in the qualitative standard and is limited to 30 credit hours.

TREATMENT OF SELECTED GRADES

Withdrawals/Drops: Credit hours in which a student receives a grade of “W” or “WF” are included in the number of attempted hours but do not count toward successfully completed hours. Excessive withdrawals may affect your ability to meet satisfactory academic progress standards. Withdrawals affect only the quantitative standard of the SAP policy.

Incompletes: Credit hours in which a student receives a grade of “I” are included in the number of attempted hours but do not count toward successfully completed hours. In addition, grades of “I” are treated as an “F”, which negatively affects GPA. Final grades for an Incomplete grade will be included in the next SAP evaluation period. The actual grade, credits attempted, and credits earned will be used to determine if the student is making SAP.

Fails: Credit hours in which a student receives a grade of “F”, “WF”, “R” is included in the number of attempted hours, but do not count toward successfully completed hours. In addition, these grades negatively affect GPA. Students with failed grades may have difficulty meeting satisfactory academic progress standards. These grades affect both the qualitative and quantitative standards of the SAP policy.

Audit and Never Attend: An audit “AU” or never attended “NA” grade is not considered attempted coursework. It is not included in the students’ GPA or Pace evaluation. A student cannot receive financial aid for courses that he/she audits or never attends.

Repeat Courses: Per federal regulations, a student may repeat a previously passed course (grade of “D” or better) on additional time. Repeat courses are included in total attempted earned hours. the previous hours attempted and earned will continue to be counted in the total hours attempted and earned. The new grade earned from a repeated course will be used to determine eligibility

Credit by Exam: Credit hours in which a student receives a “CE” are included in attempted and completed hours for the quantitative standards of completion rate and maximum time frame. A student cannot receive financial aid for a “CE” credit.

Transfer Credit: All hours transferred and accepted from other institutions are included in the number of hours attempted and completed. In addition, a student’s maximum time to receive financial aid will be reduced by the equivalent transfer of credit hours towards his/her degree.

COVID-19: Incomplete Emergency and Withdraw Emergency: In response to the national emergency due to the COVID-19 pandemic, RCC adopted two new grades to the curriculum grading schemes: Incomplete Emergency (IE) and Withdraw Emergency (WE) grades, which are only applied to students in response to COVD-19. IE and WE grades are not included in the quantitative component of the Satisfactory Academic Progress calculation.

ELIGIBILITY STATUS

After each evaluation period, students are placed on one of the following statuses:

Satisfactory: Students who meet the minimum requirements (cumulative 2.0 GPA and 67% completion rate) are placed on this status.

Warning: Students who do not meet the minimum requirements (cumulative 2.0 GPA and 67% completion rate) for the 1st time are placed on WARNING for the following semester. Students may continue to receive financial aid during the warning period.

Suspension: Students on Warning status who fail to meet the minimum requirements again (cumulative 2.0 GPA and 67% completion rate) or have not met the minimum requirements for two consecutive terms will no longer be eligible for financial aid.

Maximum Time Frame: Students who have reached the maximum credit hours allowed for his/her program of study will be placed on this status. Attempted credits from all enrollment periods at the College + all applicable transfer credits are counted; whether or not the student received financial aid for those terms is of no consequence.

Probation: Students who have successfully appealed financial aid suspension are placed on Probation Status. Students on Probation Status are eligible to receive financial aid either for one (1) semester, after which they MUST be in satisfactory status or continuously meet the terms and conditions of the appeal plan.

Continued Probation: Students placed on Probation who successfully meet the terms and conditions of their appeal plan are placed on Continued Probation Status and eligible to receive financial aid.

Termination: Students on probation status who do not adhere to the appeal plan that he/she was given will be placed on Financial Aid Termination. Students who have been terminated are no longer eligible for financial aid until financial aid eligibility is regained (see regaining eligibility section below)

REGAINING ELIGIBILITY

Students who are placed on Termination status will be immediately ineligible for financial aid. In order to regain financial aid eligibility, students must meet the minimum requirements of RCC’s Satisfactory Academic Progress Standards by enrolling for classes at his/her own expense.

Students with new documented extenuating circumstances (must be different circumstances than the one provided in your original appeal) that are beyond their control may submit an appeal to the Financial Aid Office. If the appeal is approved, financial aid eligibility will be reinstated on a probationary status.

SAP NOTIFICATIONS OF ELIGIBILITY STATUS

The Financial Aid Office will send correspondence (via email) of eligibility status to students receiving federal and/or state aid when SAP is evaluated at the end of the semester. Eligibility status is also posted to and accessible on the students’ Self-Service portal.

APPEALING YOUR STATUS

Students who fail to meet satisfactory academic progress standards have the right to appeal their eligibility status. Students with documented extenuating circumstances that are beyond their control may have their financial aid reinstated if their appeal is approved. The burden of proof lies with the student to explain your circumstances and explain how the circumstances were extenuating, beyond your control, AND what has changed that now will allow you to meet the SAP requirements in the future.

WHAT IS CONSIDERED EXTENUATING

KEEP IN MIND: Extenuated circumstances must have been experienced by the student and/or immediate family member! Friends and extended family members cannot be included.

REASON

ACCEPTABLE

UNACCEPTABLE

Medical Illness or Injury

X

Death of Immediate Family Member

X Personal Hardship (impacted your physical, emotional, or mental health) X Young & Irresponsible (missed classes, did not study enough, incomplete work)

X My 1st time in college

X I did not like OR could not understand my instructor

X Other Unexpected Circumstances: (car accident, military deployment, loss of transportation, etc. must be documented)

X Steps to Appeal Your Status

Submit the Satisfactory Academic Progress Appeal Request Form

A personal statement explaining the circumstances that have affected academic performance AND what has changed that will allow him/her to make Satisfactory Academic Progress in a reasonable period of time prior to program graduation.

Supporting documentation must be presented. Proper documentation involve notarized statements from third party sources, medical documents, death certificate or obituary, police reports, legal or court documents, etc.

Appeal Evaluation

Only complete appeal submissions, with documentation, will be evaluated by the Financial Aid Office. The decision is final and cannot be re-appealed. The reasonableness of the student’s ability for improvement to again meet SAP standards and complete the student’s program of study will be carefully considered.

Appeals will be approved or denied. Students whose appeals are approved will be placed on a probationary status for the coming terms until full Satisfactory Academic Progress standards are met. During the probationary status, the student could be required to complete additional requirements (i.e., see a counselor, academic advisor, receive tutoring services from The Learning Center, limit enrollment, etc.) during the probationary period. The goal is to help the student get back on track for graduation. All terms, conditions, and any additional requirements of probation must be met, or the student will be placed on Termination. If an appeal plan has been pre-approved by financial aid, continuing to meet the requirements of that plan will put the student back into good standing.

All appeals submitted after the dates listed below will be evaluated and processed for the subsequent semester:

July 1 – Fall Semester

November 1 – Spring Semester

April 1 – Summer Semester

- Return to Title IV Policy

-

Federal Return of Title IV Funds Overview

Federal law specifies how the Financial Aid Office must determine the amount of Title IV program assistance that you earn if you withdraw or cease enrollment at Robeson Community College. Students who withdraw from all classes prior to completing more than 60% of an enrollment term will have their eligibility for aid recalculated based on the percent of the term completed. The Title IV programs that are covered by this law include the following financial aid programs:

- Federal Pell Grants

- Iraq and Afghanistan Service Grants

- Federal Supplemental Educational Opportunity Grants (FSEOG)

Withdrawals

Robeson Community College is an institution that is required to take attendance. For students who completely withdraw or cease enrollment, the withdrawal date is the student’s last day of attendance of a documented academically related activity. Students can officially or unofficially withdraw from the College, which both lead to a recalculation of the student’s aid.

Official Withdrawal: A student who initiates the withdrawal process by either notifying the instructor(s) or Registration Office of his/her intent to cease enrollment.

Unofficial Withdrawal: A student who stops attending classes or ceases enrollment at the College without following RCC’s official withdrawal procedure. When a student receives all F’s, W’s, or a combination of these grades for a semester, he or she may be defined as ‘unofficially withdrawn’ for Title IV purposes.

A student who attends and completes at least one course that spans the entire term will have earned the aid for that term (as adjusted for dropped classes or classes not attended).

Recalculation of Aid

Though aid is posted to the student’s account at the start of each period, students earn the funds as they complete the period. If a student withdraws during the payment period or period of enrollment, the amount of Title IV program assistance that they have earned up to that point is determined by a specific formula. If a student received less assistance than the amount that was earned, the student may be able to receive those additional funds (see post-withdrawal disbursement section below). If the student received more assistance than earned, the excess funds must be returned by the school and/or the student.

The amount of assistance that a student earns is determined on a pro-rata basis. Once the student has completed more than 60% of the payment period or period of enrollment, you earn all the assistance that you were scheduled to receive for that period.

Recalculation is based on the percent of earned aid using the following formula:

# of days completed by student DIVIDED by the total days in the semester

= Percent of Aid Earned

(excluded scheduled breaks of five days or more)

Period of enrollment and payment period: A payment period is a term, i.e., fall, spring, and summer term. For R2T4, the total number of calendar days in a term is defined by the student’s scheduled course enrollment, i.e., start and end dates of courses, excluding scheduled breaks of at least five consecutive days. The days are counted from the start date of the earliest course to the end date of the last course scheduled to complete (i.e., has the latest end-date), excluding scheduled breaks.

Scheduled Breaks: Scheduled breaks must be at least five consecutive days. It includes periods when RCC is not scheduled in session, e.g., holidays, and when the student is not scheduled to attend a course within the term

Returning Funds

If you withdraw from all courses before the 60% point of the payment period or period of enrollment, RCC is required to return a portion of the financial aid that was not earned. Robeson Community College must return a portion of the excess equal to the lesser of:

- The amount of institutional charges multiplied by the percentage of funds that was not earned, or

- The amount of Title IV funds that the student does not earn

RCC must return this amount even if it didn’t keep this amount of your Title IV program funds. There may be instances when both RCC, and the student may have a responsibility for returning funds.

If you did not receive all of the funds that you earned, you may be due a post-withdrawal disbursement. Robeson Community College will automatically use all or a portion of your post-withdrawal disbursement of grant funds for tuition and fees.

Post-Withdrawal Disbursements

If you did not receive all of the funds that you earned, you may be due a post-withdrawal disbursement of the earned aid that was not received. Financial Aid staff will notify students via a letter mailed to the student’s address on file within 30 days of the date of determination of any post-withdrawal disbursements due. Post-withdrawals disbursements of grant aid earned will be disbursed to the student account as soon as possible, but no later than 45 days after the date RCC determined that the student withdrew.

Robeson Community College will automatically use all or a portion of the post-withdrawal disbursement of grant funds to satisfy outstanding allowable charges on the student account. Any remainder of post-withdrawal grant disbursements resulting in a credit balance will be disbursed to the student within 14 days.

Return of Unearned Funds to Title IV Programs

If a student withdraws from all courses before the 60% point of the payment period or period of enrollment, RCC is required to return a portion of the financial that was not earned. Robeson Community College must return a portion of the excess equal to the lesser of:

- The amount of institutional charges multiplied by the percentage of funds that was not earned, or

- The amount of Title IV funds that the student does not earn

Student Portion: A student is responsible for all unearned Title IV program assistance that the school is not required to return. If the recalculation of aid results in an amount to be returned that exceeds the school’s portion, the student must repay some funds.

Funds will be returned to the U.S. Department of Education from the following programs in the following order (Please Note: RCC does not participate in the Federal Student Loan Program):

- Federal Pell Grants

- Federal Supplemental Educational Opportunity Grants (FSEOG)

- Iraq and Afghanistan Service Grants

Federal regulations require funds to be returned within the following timeframe:

- Official Withdrawals: 45 days from the date of determination

- Unofficial Withdrawals: 30 days from the end of the payment period

RCC must return this amount even if it didn’t keep this amount of a student’s Title IV program funds. There may be instances when both, RCC, and the student may have a responsibility for returning funds. If RCC is not required to return all of the excess funds, the student may be required to return the remaining amount.

Overpayment

Any amount of unearned grant funds that a student must return is called an overpayment. The maximum amount of a grant overpayment that a student must repay is half of the grant funds received or were scheduled to receive. Students do not have to repay a grant overpayment if the original amount of the overpayment is $50 or less. Students must make arrangements with RCC or the Department of Education to return the unearned grant funds.

The requirements for Title IV program funds when a student withdraws are separate from RCC ‘s refund policy. Therefore, a student may still owe funds to the school to cover unpaid institutional charges. RCC may also charge the student for any Title IV program funds that the College was required to return (Please see RCC ‘s Refund Policy listed below).

RCC Refund Policy – Tuition

Example of a Return to Title IV Calculation:

Student Profile: Bob Ellison is a first-time freshman at RCC. Charges to his account are as follows:

Tuition and Fees: $ 1,000.00/16-week semester

School Authorized to

Credit Account for Other Charges: Yes (all charges)

Bob’s financial aid package includes the following awards:

Pell Grant $ 1,400.00

FSEOG $ 1,200.00

Bob Ellison enrolled as a first-time freshman at RCC for the spring semester on January 8. On January 18, Bob got a call from the state treasurer informing him that the programming job he had applied for six months ago was his for the taking. That same day, Bob contacted the Financial Aid Office to:

(1) Advise them that he was withdrawing from RCC,

(2) Begin RCC’s formal withdrawal process (11 calendar days into the semester), and

(3) Find out what to do next.

RETURN CALCULATION

All of his financial aid for the semester had been disbursed.

Percentage of Federal Financial Aid Earned:

11 completed days divided by 110 days in the semester = 10%

Because this percentage is less than or equal to 60%, the student will not have earned all their aid

Amount of Federal Financial Aid Earned:

Multiply 10% X $2600 (total aid received) = $260.00

Amount of Federal Financial Aid to be Returned:

Total financial aid awarded $2,600

Minus aid earned in above calculation $ 260

Financial Aid to be returned $2,340 (see below for a breakdown of return)

Student Portion

College Portion Unearned amount of $2,340 – $900 Unearned institutional charges = $1,440

Protected Amount (50%)

Total amount of aid disbursed $2,600 X 50% =

$1,300 (protected amount)

Return amount $1,440 – Protected amount $1,300 =

Total for Student to Return: $140.00

The lesser of:

- $1,000 (institutional charges)

90% Unearned Percentage $900

OR

- Amount of unearned Aid = $2,340

Total for RCC to Return: $900.00**RCC returns the $900 to the Department of Education, creating a balance on the student’s RCC account. The student is responsible for paying their RCC balance of $900 in addition to the $140 student portion to be returned.

- What is a FAFSA?

-

The Free Application for Federal Student Aid (FAFSA®) form is an application for federal student aid. You need to complete the FAFSA form to apply for federal student aid such as federal grants, work-study funds, and loans. Completing and submitting the FAFSA form is free and easier than ever, and it gives you access to federal student aid—the largest source of aid— to help you pay for college or career/trade school.

- Who should complete the FAFSA form?

-

Any student, regardless of income, who wants to be considered for federal, state, and school financial aid programs. This includes grants, scholarships, work-study funds, and loans.

Many states and colleges use your FAFSA information to determine your eligibility for state and school aid. Some private aid providers may use your FAFSA information to determine whether you qualify for their aid.

- How do I apply for financial aid?

-

To apply for financial aid, you must complete the Free Application for Federal Student Aid (FAFSA) at FAFSA® Application | Federal Student Aid

HELPFUL TIP: Make sure to select the correct FAFSA year as there may be two versions available. If you plan to enroll in school for the current 2023-2024 year (Fall 2023, Spring 2024, and Summer 2024), select and complete the 2023-2024 FAFSA. If you are planning to enroll for the next school year 2024-2025 (Fall 2024, Spring 2025, or Summer 2025), select and complete the 2024-2025 FAFSA.

For assistance with completing your FAFSA, please visit the Financial Aid Office.

- What is the school code for RCC?

-

RCC’s school code is 008612

- What is a FSA ID & how do you obtain it?

-

The FSA ID (account username and password) allows individuals to access Federal Student Aid websites and complete the FAFSA form online.

For the 2024–25 Free Application for Federal Student Aid (FAFSA®) form, students and contributors (parents or spouses) are required to have an FSA ID to complete and sign the form online.

If you don’t already have an FSA ID, you can create an FSA ID.

Contributors: If you previously created an FSA ID when you were a student, you don’t need to create another one. You can only have one FSA ID.

- What if I forgot my FSA Username or password?

-

If you have an FSA ID but don’t remember your username, select “Forgot Username.” Note: If you verified your email address or mobile phone number during account creation, you can enter your email address or mobile phone number instead of your username.

If you have an FSA ID but don’t remember your password, select “Forgot Password.”

Important: To retrieve your username or password, you’ll either need to have a code sent to your mobile phone or your email address, or you’ll need to answer your challenge questions. If you haven’t provided and verified your mobile phone number or email address in your FSA ID account, and you can’t remember the answers to your challenge questions, you will have to contact the Federal Student Aid Information Center by calling 1-800-4-FED-AID (1-800-433-3243; TTY for the deaf or hard of hearing 1-800-437-0833). An agent will walk you through self-service options. If that does not resolve the situation, you will need to go through the FSA ID account recovery process. You’ll send in copies of identification, and an email address you have access to, and your account will be reset to include that new address. This process takes 7–10 days from the point at which you send in your documentation.

Once you regain access to your account, we strongly encourage you to provide and verify both your email address and phone number so that in the future you can retrieve your username or password on your own.

Recovering Your Username

Click the “Forgot My Username” (or similar) link on the site you want to log in to, and select one of the following options:

Option 1: “Text a secure code to my mobile phone” (your mobile phone must be verified to use this option).

- Enter your mobile phone number and the month and day of your birthday.

- Enter the secure code from your mobile phone.

- Your username is shown on the screen.

Option 2: “Email a secure code”

- Enter your email address and the month and day of your birthday

- Enter the secure code from your email.

- Your username is shown on screen.

Option 3: “Answer my challenge questions”

- Enter your SSN, last name, and date of birth.

- Answer your challenge questions correctly.

- Your username is shown on screen.

Recovering Your Password

Click the “Forgot My Password” (or similar) link on the site you want to log in to, and select one of the following options:

Option 1: “Use my username or verified email address.”

- Enter your username or verified email address and the month and day of your birthday.

- Select one of the three options for recovery:

- Text a secure code to my mobile phone

- Email a secure code

- Answer my challenge questions*

- Create a new password.

Option 2: “Use my mobile phone number”

- Enter your verified mobile phone number and the month and day of your birthday.

- Select one of the three options for recovery:

- Text a secure code to my mobile phone

- Email a secure code

- Answer my challenge questions*

- Create a new password

*Please note that for security purposes, if you use the challenge question option to reset your password, there’s a 30-minute delay before you can use your FSA ID.

- What if my family's financial situation changes?

-

If you or your family has unusual circumstances not shown on the FAFSA (such as loss of employment) that might affect your need for student financial aid, submit the FAFSA and then complete a Professional Judgment Request form with RCC Financial Aid Office.

- What documents are needed to complete the FAFSA?

-

The FAFSA questions ask for information about you (your name, date of birth, address, etc.) and about your financial situation. Depending on your circumstances (for instance, whether you’re a U.S. citizen or what tax form you used), you might need the following information or documents as you fill out the application:

- Your Social Security number (it’s important that you enter it correctly on the FAFSA form!)

- Your parents’ Social Security numbers if you are a dependent student

- Your driver’s license number if you have one

- Your Alien Registration number if you are not a U.S. citizen

- Federal tax information or tax returns including IRS W-2 information, for you (and your spouse, if you are married), and for your parents if you are a dependent student:

- IRS 1040

- Foreign tax return, IRS 1040NR, or IRS 1040NR-EZ

- Tax return for Puerto Rico, Guam, American Samoa, the U.S. Virgin Islands, the Marshall Islands, the Federated States of Micronesia, or Palau

- Records of your untaxed income, such as child support received, interest income, and veterans noneducation benefits, for you, and for your parents if you are a dependent student

- Information on cash; savings and checking account balances; investments, including stocks and bonds and real estate (but not including the home in which you live); and business and farm assets for you, and for your parents if you are a dependent student

Keep these records! You may need them again. Do not mail your records to us.

- What is verification?

-

Verification is a review of the information you reported on your FAFSA application. Students are randomly selected by the Department of Education for verification. If selected, you will be required to obtain submit certain documents. To access a list of the requested documents, log into your student Self-Service portal, click on “Financial Aid Counseling, and then “Requested Documents”.

- Does financial aid pay for developmental coursework?

-

Financial aid will only pay for 30 credit hours of attempted developmental coursework.

- What Is the IRS Data Retrieval Tool (DRT)?

-

The IRS Data Retrieval Tool (IRS DRT) is located within the income section of the FAFSA application and allows the applicant to transfer their tax information from the IRS directly to the FAFSA. You must use the IRS DRT whenever possible. If you do not you may have to submit hard copies of your tax documents to the Financial Aid Office.

- Is there a limit to how long I can receive financial aid?

-

Most financial aid funding have limits to how long you can receive aid. You can receive aid (if eligible) up to the following:

- Federal Pell Grant: 6 full-time years or 12 full-time academic semesters

- NC Community College Grant: 10 full-time academic semesters

- NC Education Lottery Grant: 10 full-time academic semesters

Please note that even though you may have available funding remaining, you must also maintain Satisfactory Academic Progress standards of maximum time frame, which indicates that a student must complete their program of study within a time frame of 150% of the published program length. For example, if you are enrolled in a program that requires 60 credits to complete, financial aid will cover up to 90 credits (60 credits * 150% = 90 credits).

- I am thinking of withdrawing, will I have to return my financial aid funds?

-

Question 1

Did you cease to attend a course that you was scheduled to attend? (If yes, ask the next question.) If no, a return calculation is not required.

Question 2

At the time you stopped attending this course, were you continuing to attend other courses? If no, go on to Question #3. If yes, you are not a withdrawal at this point.

Questions 3

At the time of withdrawal, did you provide written confirmation of anticipated attendance in a later starting, registered course within the term? If no, a return calculation is required. If yes, no return calculation is required

Return Calculation: A student’s official withdrawal date is used to determine how much financial aid was earned during enrollment for the semester. All unearned portions of financial aid must be returned to the Department of Education. This may leave the student with a balance owed to Robeson Community College. Students will not be eligible to receive additional financial aid for post-secondary education until all unearned portions of financial aid are repaid.

|

|

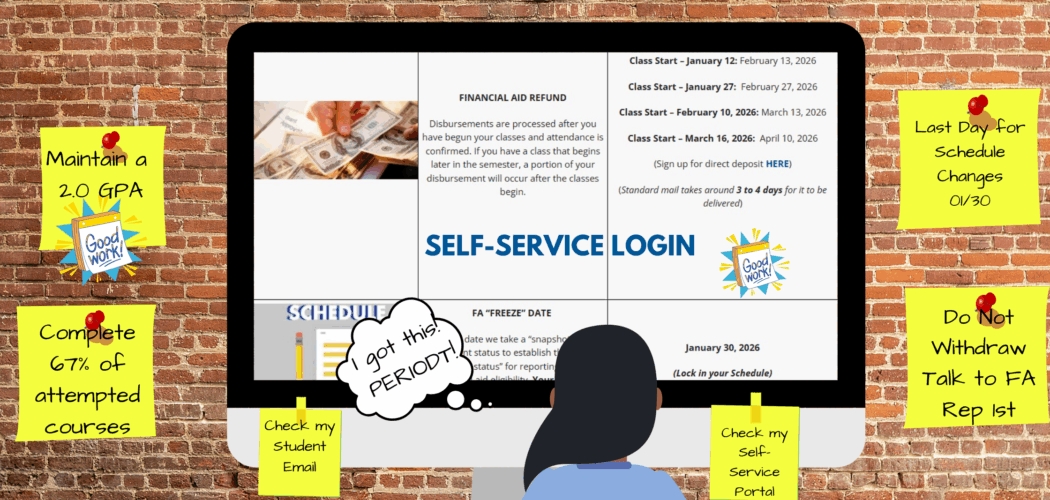

PAYMENT DEADLINES |

Class Start – January 12: January 7, 2026 Class Start – January 27: January 22, 2026 Class Start – February 10, 2026: February 5, 2026 Class Start – March 16, 2026: March 11, 2026 |

|

BOOKSTORE DATES |

Class Start – January 12, 2026: 1/8 – 1/30 Class Start – January 27, 2026: 1/26 – 1/30 Class Start – February 10, 2026: 2/09 – 02/13 Class Start – March 16, 2026: 3/13 – 3/20 |

|

|

FINANCIAL AID REFUND Disbursements are processed after you have begun your classes and attendance is confirmed. If you have a class that begins later in the semester, a portion of your disbursement will occur after the classes begin.

|

Class Start – January 12: February 13, 2026 Class Start – January 27: February 27, 2026 Class Start – February 10, 2026: March 13, 2026 Class Start – March 16, 2026: April 10, 2026 (Sign up for direct deposit HERE) (Standard mail takes around 3 to 4 days for it to be delivered)

|

|

FA “FREEZE” DATE This is the date we take a “snapshot” of your enrollment status to establish the “official enrollment status” for reporting purposes and financial aid eligibility. Your enrollment status on this day is what will be used to calculate your disbursement. |

January 30, 2026 (Lock in your Schedule) |

MEET THE STAFF

Through a sincere commitment to all students and their families, we strive to eliminate financial and other barriers to higher education. We make a conscious effort to reach out to those with exceptional economic and educational needs. We are dedicated to providing high-quality service in a fair, sensitive, and confidential environment to all individuals.

We’re here to provide information about the types of financial aid available to students, financial aid application deadlines, how to accurately complete the FAFSA and any other forms, how much aid you are qualified to receive, ways to avoid or minimize borrowing, and how to request an appeal of certain financial aid decisions. Financial aid administrators are required to abide by the rules and regulations of the programs they administer. Please read all the information given to you, abide by the guidelines, and ask questions if you don’t understand something.

Students are assigned a financial aid specialist based on your last name.

Find your assigned financial aid specialist below.

|

LOPES, ZILMADirector of Financial Aid & Veteran Services |Veterans School Certifying Official Office: Building – 13, Room 1318 |

|

MOORE, BRITTANYFinancial Aid Specialist (Last Name: A – L) | Scholarship Coordinator Office: Building – 13, Room 1311 |

|

HUNT, JESSIEAssistant Director of Financial Aid & Veteran Services Office: Building – 13, Room 1312b |

|

ELLIS, KEATSFinancial Aid Specialist (Last Name: M – Z) | Veterans School Certifying Official Office: Building – 13, Room 1314 |

|

|

SALVADOR-GONZALEZ, ATZELFinancial Aid Specialist – Document Processing/Front Desk Services/ Spanish Interpreter Office: Front Desk – Financial Aid |

CONTACT US

|

|

Location: 5160 Fayetteville Road, Lumberton, NC 28360 – Building 13, Mailing Address: P.O. Box 1460, Lumberton, NC 28359 Phone Number: 910-272-3352 Fax Number: 910-272-3314 Email: finaid@robeson.edu Hours: Monday – Thursday: 8:00 am to 6:00 pm, Friday: 8:00 am to 3:00 pm Like our Facebook page to stay tapped in about important financial aid information, deadlines, scholarships, and more! |

Bienvenido a la Oficina de Ayuda Financiera.

Su educación en Robeson Community College es una de las inversiones más valiosas que hará en su vida. La oficina de ayuda financiera está comprometida a ayudarle a encontrar maneras de financiar su educación porque creemos que asistir a la universidad no debe estar limitado por los recursos financieros de su familia. Hemos diseñado este sitio web para ayudarle a guiarlo a través del proceso de ayuda financiera. Le instamos a mantenerse informado y en control de su educación navegando a través de nuestro sitio web, revisando su correo electrónico para estudiantes de RCC y revisando su portal de estudiantes de autoservicio.

- Solicitar ayuda financiera

-

Haga clic en el siguiente enlace para completar la Solicitud Gratuita de Ayuda Federal de Stuent (FAFSA).

- Becas

-

Becas Universitarias para Estudiantes Hispanos y Latinos:

https://study.com/resources/becas-universitarias-para-estudiantes-hispanos-y-latinos